How does PayPal work with a bank account?

PayPal is a widely-used online payment platform that allows individuals and businesses to send and receive money securely and conveniently. One of the key features of PayPal is its integration with bank accounts, making it easier for users to manage their finances. In this blog post, we'll take a closer look at how PayPal works with a bank account, from setting up the connection to making transactions.

Read More: How to Transfer Money From Bank Account to PayPal

Setting Up Your Bank Account with PayPal

Creating a PayPal Account: The first step is to create a PayPal account if you don't already have one. Visit the PayPal website (www.paypal.com) and click on the "Sign Up" button to get started. You'll need to provide your personal information, email address, and create a secure password.

Verifying Your Identity: To link your bank account with PayPal, you'll need to verify your identity. This typically involves confirming your email address and phone number and providing additional information as required by PayPal's security measures.

Linking Your Bank Account: Once your PayPal account is set up and verified, you can link your bank account. To do this, navigate to the "Wallet" section of your PayPal account and click on "Link a bank account." PayPal will guide you through the process, which may include entering your bank account details and confirming small test deposits.

How PayPal Works with Your Bank Account?

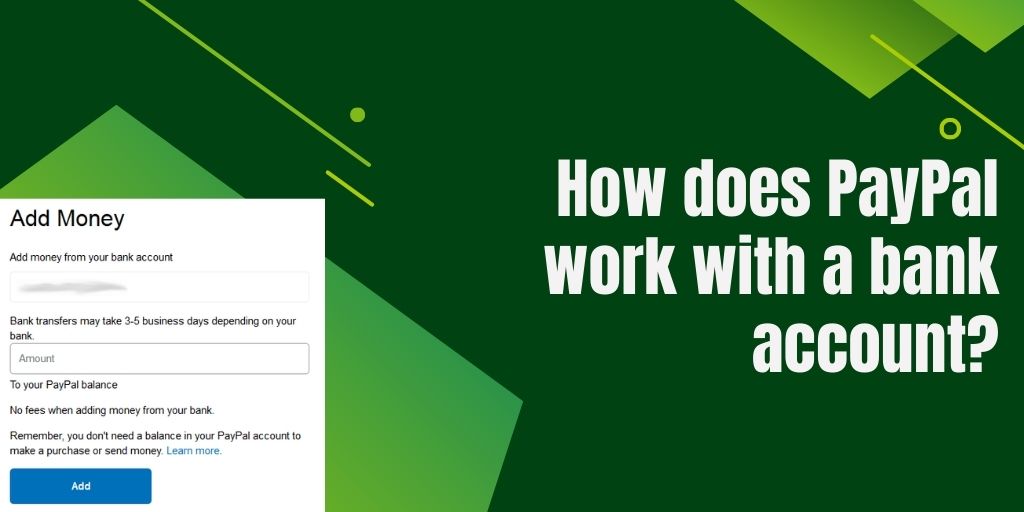

Adding Funds: After linking your bank account, you can add funds to your PayPal balance. This can be done by transferring money from your bank account to your PayPal account. PayPal provides a "Add Money" option where you can specify the amount you want to transfer. This balance can be used to make purchases or send money to others.

Withdrawing Funds: If you have money in your PayPal account that you want to access in your bank account, you can initiate a withdrawal. This process transfers funds from your PayPal account to your linked bank account. It usually takes a few business days for the transfer to complete.

Making Payments: PayPal allows you to make payments directly from your bank account using your PayPal account as an intermediary. When you make a purchase or send money, PayPal will deduct the amount from your bank account, provided you have linked it.

Receiving Payments: If you're a seller, PayPal enables you to receive payments from customers, which are then transferred to your linked bank account. This is especially useful for e-commerce businesses and freelancers who want a secure and convenient way to get paid.

Security Measures

PayPal takes security seriously to protect both your bank account and your financial transactions. Some security features include:

Two-factor Authentication (2FA): Enable 2FA to add an extra layer of security to your PayPal account.

Purchase Protection: PayPal offers purchase protection for eligible transactions, ensuring that you're covered in case of disputes.

Encrypted Transactions: All transactions conducted through PayPal are encrypted, making it difficult for unauthorized individuals to intercept your data.

Conclusion

PayPal's integration with your bank account simplifies online transactions, making it easy to manage your money. Whether you want to make payments, receive funds, or simply keep track of your finances, PayPal offers a user-friendly solution with robust security measures. By linking your bank account and using PayPal wisely, you can enjoy the convenience and peace of mind that come with this popular online payment platform.

Comments

Post a Comment